Dear Client,

Review Your Comprehensive Motor Insurance Sum Insured by August 2025

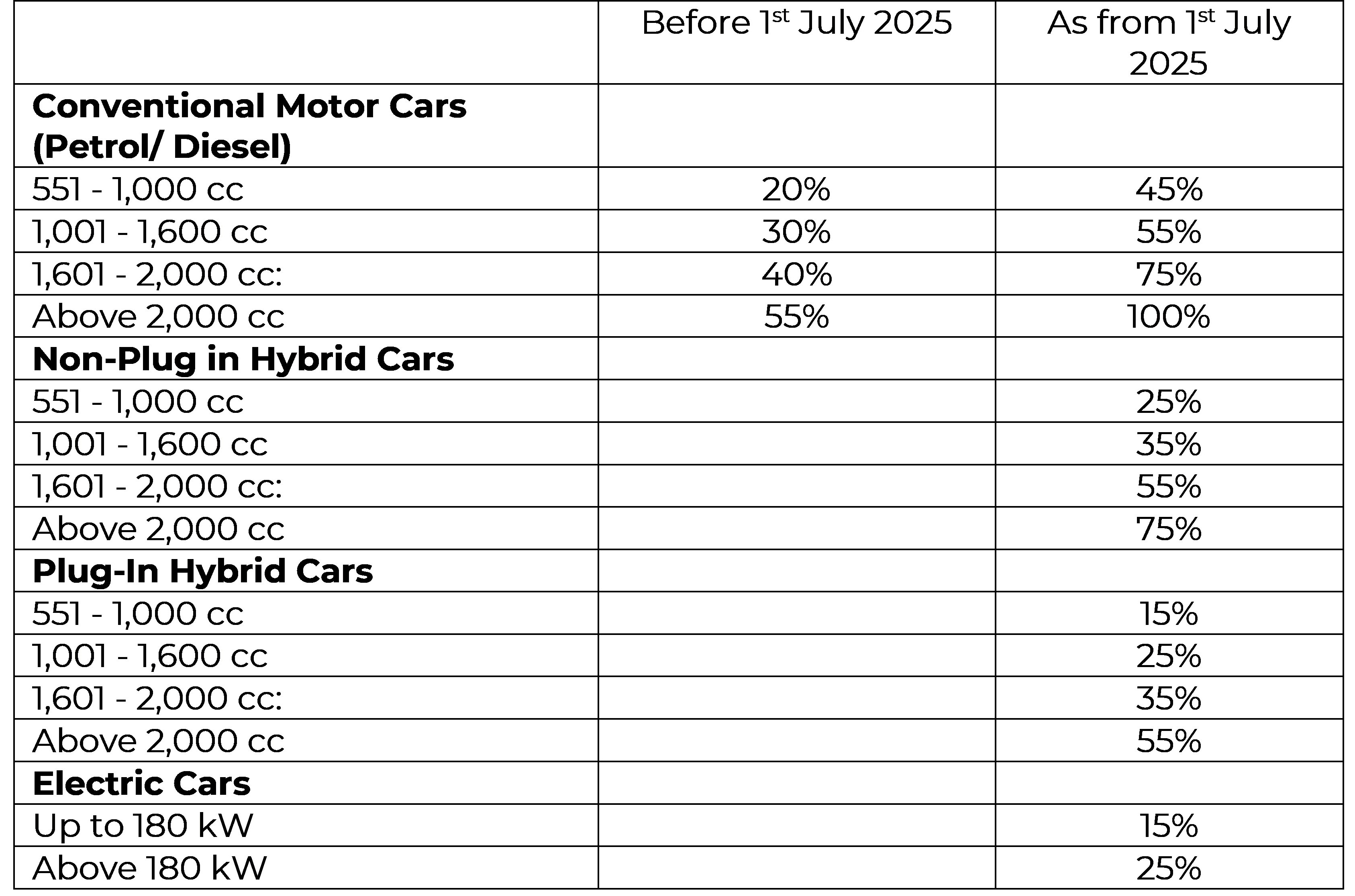

As announced in the National Budget 2025-2026, higher vehicle taxes and registration fees will take effect as from 1st July 2025. This change will increase the price of new motor vehicles and is also expected to impact the market value of second-hand motor vehicles. For reference, you can consult the table in the Questions and Answers section, which provides an indication of the range of tax increases across different types of motor vehicles.

What does this mean for your comprehensive motor insurance?

With these new vehicle prices, it may be necessary for you to increase the Sum Insured on your motor policy (i.e., the declared value of your motor vehicle) to reflect the higher market values (if applicable).

If your car is under-insured (i.e. it’s insured for less than its actual market value), in the unfortunate event of an accident, your claim payout could be reduced, both for repairs and in the event of a total loss. This is a standard practice for comprehensive insurance as provided by the “Under-Insurance” clause of your policy with us.

Good news: You have until 31st August 2025 to review your Sum Insured.

As these changes will take effect in only a few days' time; 1st July and we understand that there is some uncertainty regarding the new market value of motor vehicles, we fully appreciate that it may take some time for you to assess if and how these changes affect your vehicle's value.

You have until the end of August to review and update your Sum Insured, if needed. This gives you plenty of time to make sure your coverage reflects your car’s current value.

We also want to reassure you that if a claim arises during this period, the “Under-Insurance” clause will not be applied. This means your claim payout will be based on the current market value of your vehicle, in line with your motor insurance policy and any vehicle acquisition agreements — including those related to duty-free privileges.

What will happen from 1st September 2025 if my Sum Insured is below its Market Value?

If your Sum Insured is below its true market value and if you happen to have an accident as from 1st September 2025, rest assured that you will still be covered. However, your claim payout may have to be reduced proportionately in accordance with the “Under-Insurance” clause.

By giving you until 31st August to review your Sum Insured and choosing not to apply the “Under-Insurance” clause right away, we want you to know that we truly understand how much your vehicle means to you — and that your peace of mind matters most. It’s our way of helping ensure your motor vehicle is properly protected.

Our team will reach out to you in the next few weeks on the next steps should you want to increase your Sum Insured. In the meantime, if you have any questions or need assistance in reviewing your policy, please don’t hesitate to contact our Sales Team at [email protected].

You can also consult of QnAs listed below.

Questions and Answers

1. What are the expected tax increases for different types of motor vehicles?

For indication purposes, here is an overview of the range of tax increases for the different types of motor vehicles:

Source:

MRA- mra.mu/customs1/motor-vehicles

Government of Mauritius National Budget- https://govmu.org/EN/budget/Pages/default.aspx

2. How can I find out the revised value of my car?

You have a few options to determine your car’s updated market value:

- Contact your car dealer – especially if you purchased your car within the past year.

- Consult a professional surveyor – they can provide a reliable car valuation.

- Use the MyCar.mu Value Calculator – a 3rd party online tool to estimate your car’s current value.

3. What is the under-insurance clause?

The under-insurance clause is a standard part of most comprehensive motor insurance policies.

If the Sum Insured in respect of the insured motor vehicle is at the time of any loss or damage, lower than its Market Value by more than 15%, the policyholder will be considered as being his/her own insurer for the difference and any indemnity under this Section of the Policy shall be limited to the proportion which the Sum Insured bears to the Market Value of the vehicle

In such cases, any payout you receive will be reduced in proportion to the shortfall.

For example: If your car’s market value is Rs 1,000,000 but it’s only insured for Rs 800,000 (a 20% gap), your claim payout will be adjusted accordingly by 20%.

4. What if I don’t update my Sum Insured by the end of August 2025?

If you don’t increase your Sum Insured to reflect your car’s current value:

• In case of an accident (repairs): Your payout could be reduced.

For example, if your car’s value increased by 20% but your Sum Insured wasn't adjusted, you may only be covered up to only 80% of the repair costs, resulting in a 20% shortfall that you will have to bear.

• In case of a total loss: Your payout will only cover the insured amount — not the full market value — in accordance with your motor insurance policy.

5. What if I wait until my next renewal to update my Sum Insured?

The same risks as Question 3 will apply. Until your Sum Insured is revised, you may receive a reduced compensation if you file a claim unless the claim occurs during the months of July & August (as explained above).

Please note: At your next renewal, your policy should reflect the car’s current market value to ensure full protection.

6. What happened if my car value has increased by less than 15% and I did not increased the sum insured of my vehicle?

• In case of an accident (repairs): Under insurance will not be applicable for repair.

• In case of a total loss: Your payout will only cover the insured amount — not the full market value — in accordance with your motor insurance policy.

7. If I decide to increase my Sum Insured, will I have to pay an additional premium?

Yes, increasing your Sum Insured will result in an additional premium.

This extra amount will cover the period from 1st September until your policy's expiry date, and ensures you're fully protected for higher repair costs or a total loss if an accident happens.

8. Does this apply if I have third-party insurance?

As there is no sum-insured for a third-party cover, you do not need to do anything and the under-insurance clause will also not apply.

9. What if I purchased my insurance through a broker or sales agent?

Your broker or agent will contact you and will then inform us accordingly of any increase to your Sum Insured.